Webinar series on SEZ Policies and Procedures - Episode 1

29/09/2021 | Completed Event

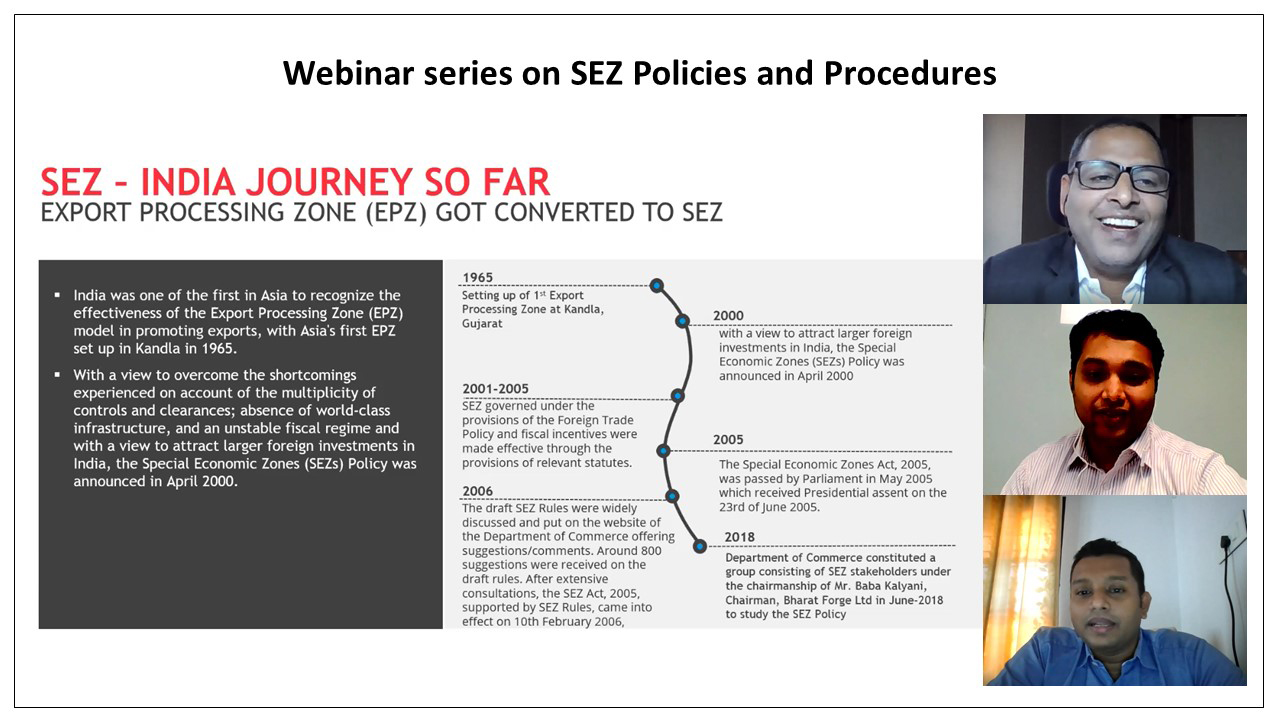

We organized a webinar on SEZ Policies and Procedures that discussed tax benefits, SOFTEX filing, SEIS Scheme etc. Mr. Krishna Barad, Partner - Customs & International Trade, Indirect Tax - BDO India was the speaker. The programme was conducted in association with NASSCOM. Mr. Barad gave an overview of the evolution of special Economic Zones in India. He briefed the participants on the features of the SEZ Act 2005 and SEZ Rules 2006. There was a comparison of the SEZ and EOUs with respect to Registrations, permissions, renewals, returns, fiscal benefits direct taxes, FTP benefits, tax benefits etc. He explained the functions of the different modules of SEZ online like the unit/developer/ co-developer regularization, LOA, LUT. Mr. Barad listed the documents required for import into SEZ along with the other prerequisites and the procedure. He also discussed the periodical reports that needs to be filed with SEZ Portal and their due dates like – monthly performance report, Service Exports Reporting form, SOFTEX form for IT/ ITeS units. The challenges faced by SEZ units currently include – CAROTAR Compliance, Land utilization and segregation, denotification, SCOMET authorizations, Work from home permissions, tracking of IT assets etc. Mr. Vivek George, Manager, World Trade Center and Mr. Sujith Unni, Regional Head, NASSCOM also spoke at the event.